It’s always good to re-read books and to dip back into them periodically. When reading a new book, I often miss out on crucial information (especially books that are hard to categorize with one descriptive sentence). When you come back to a book after reading hundreds of others you can’t help but make new connections with the old book and see it anew.

It has been a while since I read Anti-fragile. In the past I’ve talked about an Antifragile Way of Life, Learning to Love Volatility, the Definition of Antifragility , Antifragile life of economy, and the Noise and the Signal.

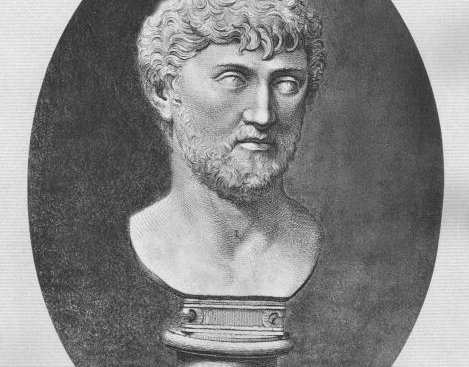

But upon re-reading Antifragile I came across the Lucretius Problem and I thought I’d share an excerpt. (Titus Lucretius Carus was a Roman poet and philosopher, best-known for his poem On the Nature of Things). Taleb writes:

[time-brightcove not-tgx=”true”]Indeed, our bodies discover probabilities in a very sophisticated manner and assess risks much better than our intellects do. To take one example, risk management professionals look in the past for information on the so-called worst-case scenario and use it to estimate future risks – this method is called “stress testing.” They take the worst historical recession, the worst war, the worst historical move in interest rates, or the worst point in unemployment as an exact estimate for the worst future outcome. But they never notice the following inconsistency: this so-called worst-case event, when it happened, exceeded the worst [known] case at the time.

I have called this mental defect the Lucretius problem, after the Latin poetic philosopher who wrote that the fool believes that the tallest mountain in the world will be equal to the tallest one he has observed. We consider the biggest object of any kind that we have seen in our lives or hear about as the largest item that can possibly exist. And we have been doing this for millennia.

Taleb brings up an interesting point, which is that our documented history can blind us. All we know is what we have been able to record.

We think because we have sophisticated data collecting techniques that we can capture all the data necessary to make decisions. We think we can use our current statistical techniques to draw historical trends using historical data without acknowledging the fact that past data recorders had fewer tools to capture the dark figure of unreported data. We also overestimate the validity of what has been recorded before and thus the trends we draw might tell a different story if we had the dark figure of unreported data.

Taleb continues:

The same can be seen in the Fukushima nuclear reactor, which experienced a catastrophic failure in 2011 when a tsunami struck. It had been built to withstand the worst past historical earthquake, with the builders not imagining much worse— and not thinking that the worst past event had to be a surprise, as it had no precedent. Likewise, the former chairman of the Federal Reserve, Fragilista Doctor Alan Greenspan, in his apology to Congress offered the classic “It never happened before.” Well, nature, unlike Fragilista Greenspan, prepares for what has not happened before, assuming worse harm is possible.

So what do we do and how do we deal with the blindness?

Taleb provides an answer which is to develop layers of redundancy to act as a buffer against oneself. We overvalue what we have recorded and assume it tells us the worst and best possible outcomes. Redundant layers are a buffer against our tendency to think what has been recorded is a map of the whole terrain. An example of a redundant feature could be a rainy day fund which acts as an insurance policy against something catastrophic such as a job loss that allows you to survive and fight another day.

Antifragile is a great book to read and you might learn something about yourself and the world you live in by reading it or in my case re-reading it.

This piece originally appeared on Farnam Street.

Join over 60,000 readers and get a free weekly update via email here.

TIME Ideas hosts the world's leading voices, providing commentary on events in news, society, and culture. We welcome outside contributions. Opinions expressed do not necessarily reflect the views of TIME editors.